How innovation is shaping the future of banking in 2024

Contact info for Pablo Alaejos Perez

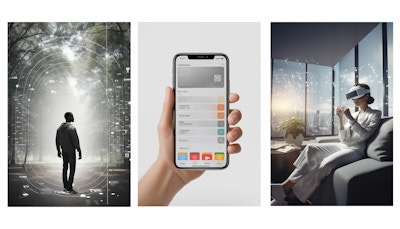

Welcome to the future of banking, where the transformative power of technologies like artificial intelligence (AI), open banking, and blockchain are revolutionising the banking industry and redefining customer experiences. This article will take you through some of the trends we’re seeing around creating hyper-personalised experiences, lifestyle-driven banking, how super-apps are changing the financial sector globally, and much more. So, buckle up and get ready for a journey into the future.

1. Lifestyle banking

Winning customer loyalty with lifestyle-led accounts.

→ Insight

As consumer trends progress, holistic lifestyle-driven solutions will become the norm. A recent MoneyLIVE survey found that 86% of people surveyed predict lifestyle portals managing every aspect of their lives on mobile to become mainstream within the next 5 years.

→ Opportunity

Banks are in a strong position to win customer loyalty by providing in-app functionality that allows consumers to live the life they want seamlessly. Whether that’s immediate and consolidated access to your favourite brands and services, insights on how your spending contributes to your carbon footprint, or helping you build credit as a teenager. Banks now have the opportunity to “push lifestyles to the extreme.”

→ Emerging examples

Revolut Ultra offers a wide variety of lifestyle perks to a mix of big spenders, frequent travellers, and young working professionals. Fuelling their on-the-go lifestyles with on-trend subscriptions, unlimited lounge access and more.

2. Financial super-apps

Being at the centre of customers’ lives by leveraging the power of third-party services.

→ Insight

A third of US consumers said they feel overwhelmed by the number of devices and subscriptions to keep track of. With 67% of the US population showing interest in adopting super-apps as a remedy to this issue.

→ Opportunity

Super-apps provide customers with non-banking services as part of a one-stop platform, increasing the convenience and efficiency of their day-to-day. Through open banking, customers can be reached upstream, catering to the breadth of their needs, from budgeting services to ordering groceries.

→ Emerging examples

Avo, by Ned Bank, is an example of a super-app that supports its customers in various areas, e.g. banking services, healthcare, and entertainment – allowing them to access many areas of their life from a single place.

3. Hyper-personalised experience

Leveraging AI to anticipate customer needs and unlock ‘life of demand’.

→ Insight

66% of consumers expect companies to understand their unique needs and expectations, and 52% expect all offers to be personalised. This sentiment shows that applying a “one-size-fits-all” approach is no longer enough. Companies must leverage data to determine what consumers want and when they want it.

→ Opportunity

By leveraging the power of AI, banks can more intelligently price products and services within their mobile apps, increasing customer loyalty and stickiness. In a time where customer attention is the most valuable commodity, the winning providers will be those who can offer a seamless ’life on demand’ banking experience from the tap of a button.

→ Emerging examples

Personetics analyses transaction data in real-time, using machine learning to group purchasing behaviour into categories, allowing banks to offer more personalised suggestions. PriceFx adjusts prices in real-time based on customer demand, enabling businesses to optimise profits while ensuring customers receive fair prices.

4. Values-driven products

Empowering young customers to shape the future they envision.

→ Insight

Research by the US Bank found that younger generations are willing to accept lower investment returns if it aligns with their values and beliefs. This is reflected in the rapid growth of ESG (Environmental, Social, and Governance) investments, projected to reach US$ 33.9 trillion by 2026.

→ Opportunity

The bank of the future will push the frontier of ESG, providing customers with increasingly granular options on what to invest in within their banking apps. Offering unique portfolios, like women or LBTQIA+-led companies, will attract young customers who want to put their money into companies they believe in.

→ Emerging examples

Australian Ethical creates ‘ethically screened’ portfolios, enabling customers to invest in companies focusing on the environment, people, or animals. The investment firm Public offers the ’Women in Charge’ theme, which customers can choose to support female leadership.

5. VR servicing

Reimagining human touch with face-to-face banking in the metaverse.

→ Insight

While most consumers go to their banking app to make a decision, 28% prefer in-person servicing at the branch – a share that jumps to nearly 50% for sensitive situations, e.g. fraud.

→ Opportunity

Banking in the metaverse will allow customers to ask representatives for help and advice, amongst other things. The banks that make this experience valuable for a wide range of customers will be able to retain the ‘branch lovers’ without relying on or maintaining the costs of physical real estate.

→ Emerging examples

In early 2022, JP Morgan Chase opened its first Metaverse branch to provide services like credit, mortgages, and rental agreements. Apple’s Vision Pro hardware will bring some much-needed quality to these AR/VR experiences, raising app standards that banks will need to comply with.

6. Loyalty 3.0

Upsurging customer engagement through innovative bank-owned currencies.

→ Insight

A disruption you’re likely to see is retail banks creating their cryptocurrencies. Permission-less Smart Contracts will give daily banking customers enhanced ownership and flexibility in collecting rewards. As well as payment integration attributed to Web 3 which could expand the ways banks can reach their customers.

→ Opportunity

By giving customers more innovative ways to decide how they handle their currency, banks will begin to find themselves at the forefront of a “loyalty revolution.” In this revolution, banks will be able to build active communities that thrive off new ways to grow and use money. Cementing themselves as a core part of people’s everyday lives.

→ Emerging examples

Nubank launched its token earlier this year. Powered by the Smartchain network Polygon, ‘Nu coins’ will shape the loyalty program of some 70 million customers across South America. Customers can receive airdrops, win lotteries, and freeze Nu coins to achieve financial goals and unlock further benefits.

7. Frictionless journeys

Making unhappy paths obsolete with robust technologies that replace legacy systems.

→ Insight

After more than one bad experience, around 80% of consumers say they would rather do business with a competitor, making legacy systems a target for higher abandon rates and loss of trust.

→ Opportunity

Legacy systems contribute to poor customer experiences. But, through third-party services such as blockchain security, banks can start to overlay their outdated systems with technology that places customer needs at the centre.

→ Emerging examples

Liink, created by J.P. Morgan, is a blockchain application using Onyx’s blockchain platform to enable financial institutions and corporate users to make secure peer-to-peer data transfers with greater speed and control. Leaving banks to focus on building deeper relationships with their customers.

Curious to explore the future of banking? We’d love to hear from you. Let’s have a chat